by guest contributor Shannan Painter

We all brush our teeth, eat our vegetables and do the dishes. Why? Not necessarily because we enjoy it, but because there would be serious consequences if we neglected our bodies or our houses. Neglecting the accounting and tax portions of your business could also result in serious consequences, and yet I constantly come across people that stick their heads in the sand and wait until the mess is so big, it has to be dealt with. In their defense, many photographers are simply not well-informed when it comes to what the government requires in regards to bookkeeping. Whether that lack of information is due to not having any formal business background or not knowing where to look for it, no excuse will get you off the hook if you ever get audited!

There are a couple very simple steps you can take to ensure that not only are you in compliance with government requirements, but in addition, that you understand your business finances.

Establish a routine

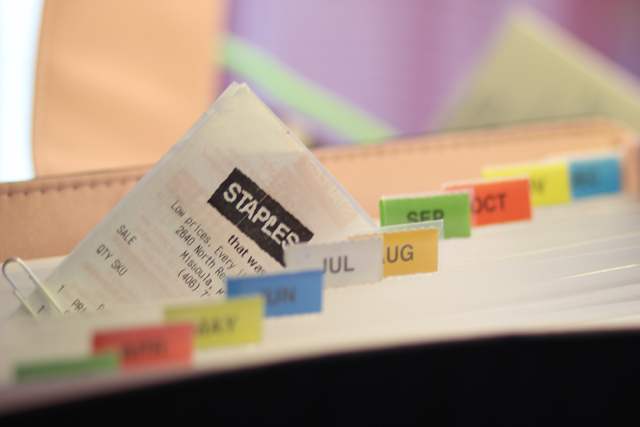

The government requires you to keep a set of books for your business – but the records themselves are not enough proof for deductions. You have to keep receipts, invoices and other documents to support your purchases (always make sure to ask for a receipt). What do you do with these receipts?

- My routine is to keep each receipt in my wallet.

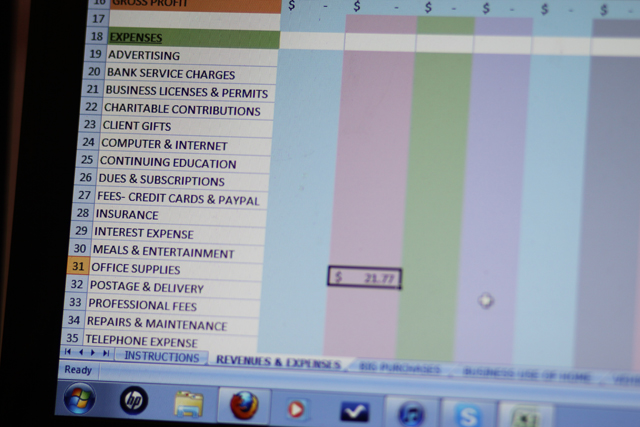

- Once my wallet gets full, I post each transaction to my profit & loss spreadsheet.

- After each transaction is posted, I file the receipts into an accordion file sorted by month. They are readily and easily accessible if I need to go back and find one. More importantly, I have the documentation to support my business deductions. Records must be kept for a minimum of two years.

Educate yourself

You don’t need to be a CPA, have an MBA or any letters after your name for that matter, but you do need to understand the basic principles of tax consequences. For example, you need to know that you will likely have to pay self-employment tax, depending upon how your business is organized, on any profits you make. Our Business 101: Setting Up Shop e-Guide is an excellent resource to gaining a basic understanding of financial organization, business deductions, and tax consequences specifically for photographers.

SAVE 50% off any of these fantastic business tools from Photographer Depot that will help you keep track of your income and expenses, and save you time and money (expires January 12th, 2014)

Snapshot Easy to use Spreadsheet for Photographers

Business 101: Setting Up Shop e-Guide

![]()

About the Author: Shannan Painter is a newbie photographer who has spent the last 5 years working with the left side of her brain helping small businesses organize their accounting and taxes. She decided to take the big step and pursue her dream of becoming a professional photographer in 2013 after adding a third boy to her house that was already full of super heroes, trucks, and sports equipment. She and her husband, who is a local TV meteorologist, play pick-up games of basketball in their free time and like to take road trips to Lake Minnetonka with all 3 boys, and their dog Growler.

Visit Shannan at her WEBSITE | FACEBOOK page today

I’d like to add that although it might be troublesome to work on the finances every week, it sure beats letting it all add up and then at the end of the month having to look at a stack of receipts. (although I have to admit I do that sometimes)..

And usually the amount of time you need to hold on to records is from the date the return is filed and not a receipt date.

Yes, Erin, thank you for pointing that out for clarification. You do need to hold on to records 2 years from the date the return is filed, and not the receipt date.

It sounds like you are doing a great job! Keep it up!

I am trying to be good about it. I set up my accounting with Wave Accounting the main reason was that it was online, I can link it to my biz account and paypal and it’s free.

I don’t really enjoy doing it but at least I know exactly where I am financially

I know it says it works with open office etc… but will it work with Numbers on iMac? I’ve got my own spreadsheet but feel i could use something a bit better

Hi Christine,

The spreadsheet has worked with older versions of Numbers, however, we have had some users using updated versions of numbers that experience incompatibility issues. At this current time, we are not suggesting use with numbers.